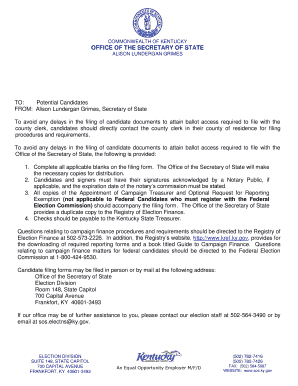

Get the free fillable authorization mortgage form

Get, Create, Make and Sign sba borrower certification form

Editing borrowers cert and authorization online

How to fill out fillable borrower template form

How to fill out SBA Borrower's Certification

Who needs SBA Borrower's Certification?

Video instructions and help with filling out and completing fillable authorization mortgage form

Instructions and Help about fillable borrower

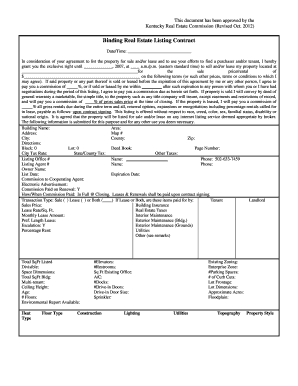

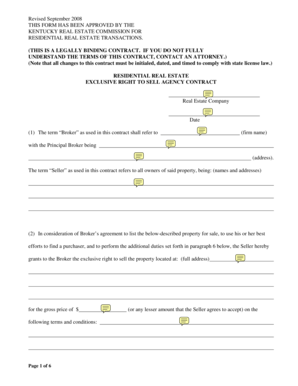

This form is called a borrower certification and authorization in this form is part of your mortgage application that you would complete when you apply for a mortgage companies Equuleus mortgage LLC and my name is Jeremy Randy's I am a certified mortgage planning specialist and also a certified residential mortgage specialist the borrow authorization certification this part just saying basically the information that you provide to us is true and accurate to the best of your knowledge and also this form authorizes us to go ahead and request or verify information like employment your assets income etc anything that's pertinent to the application you give us the authorization to verify going to add to the middle of the form mortgage fraud prevention that's just stating that mortgage fraud willfully not disclosing or disclosing fraudulent information it is a crime, and it could be punishable in fines or jail time go down to the bottom of the form it also stays an affidavit of occupancy if you're saying that the problem the residence is going to be a primary residence testing well then you must occupy within 30 days of closing if you say, and it's a secondary residence you have to occupy it at least 15 days of the year and that down here if it's an investment property then you're just saying you're purchasing it to be either hell or rented out as an investment disclosure at the bottom of this form I will get into that in additional videos one by one on YouTube, so you could view it at your leisure for information and the more information you have the better decision you can make regarding your mortgage you should know exactly what you're what you're doing and how to properly invest in real estate the bottom here is where the borrower sign and date and the Cobra on a date this is Justin disclosure and that's not a contract it's just saying that it has to be disclosed to you, and you have to sign it, so we could verify the information and request additional documents if we eat it now our company is equalized mortgage LLC and this is my name Jeremy rammed us I'm a certified mortgage planning specialist and the certified residential mortgage specialist and also a general Mortgage Association associate these are higher level of training that I have acquired and certification that I have received upon completion of those training in order to better serve you in a more professional efficient way here's our address my phone my direct line my website address and my email if you should have any questions regarding mortgages or mortgage planning please contact me this is my number and my email address thank you

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sba borrower's certification' from Google Drive?

How do I make edits in borrowers cert and authorization mium without leaving Chrome?

Can I sign the sba loan agreement electronically in Chrome?

What is SBA Borrower's Certification?

Who is required to file SBA Borrower's Certification?

How to fill out SBA Borrower's Certification?

What is the purpose of SBA Borrower's Certification?

What information must be reported on SBA Borrower's Certification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.